When Doing Nothing is Best

To say 2022 has been a challenging time for investors is an understatement.

As 2021 drew to a close, everyone was relieved that “Covid was done” and normal life could resume. The end of 2021 saw the end of one of the longest bull runs for equity and bond markets in living memory. The start of 2022 saw a both equity and bonds come under pressure and we have had the perfect storm in the first half of 2022. Rising inflation, war in Ukraine, Covid-19 recovery and global supply shocks have all contributed to the current economic cycle. Central banks have started to raise interest rates, walking a precarious path between stifling economic growth and controlling inflation. However, inflation kills economies and therefore action was needed and has been taken to control its rise. In the UK inflation has hit 9.1% and will probably rise higher before to starts to drop.

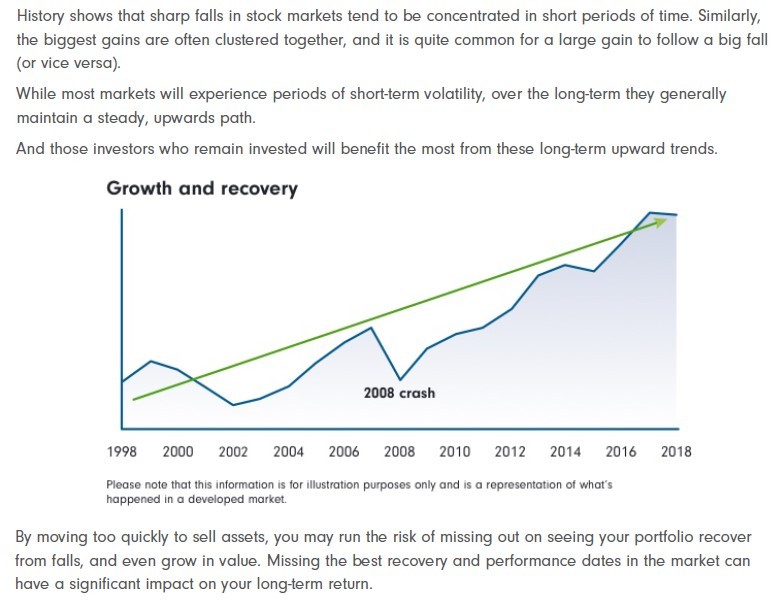

In these volatile times it is important to focus on the longer-term objectives of the investment. Investments should not have short term objectives and it is important to assess investments over a suitable 5-year time period. If you are comparing your values form December 2021 on a year-to-date basis then you are almost certainly down, however if we widen the time horizon to 5 years there will be a different perspective. There has been a divergence in certain markets. Many are asking why the FTSE 100 has performed so well since the turn of the year when my portfolio is down?

Most multi asset portfolio managers invest on a global basis and do not hold a domestic bias. The largest asset allocation is likely to be the US as it’s the biggest world market holding the most opportunities. The US market has exposure to large tech which has suffered in Q1. The UK FTSE 100 is an older more traditional market with a bias toward traditional stock such as oil, banks, mining. The war in Ukraine has led to a commodities and energy crisis pushing the share price up of the energy/mining/banks stock that are so prevalent in the FTSE 100. However, The FTSE 100 had lagged the US markets in the last 3 years, but since the turn of the year even it is now down, starting the year at 7,505.20 and currently sitting at 7,089.22.

So, what’s the alternative? If you sell to cash (and I’m sure some have considered this) you are crystallising your short-term losses. In addition, with UK inflation hitting 9%, if you hold cash in a low interest savings account, its real value will be eroded and your £100 pounds will be worth £91 in a years’ time. It is many years since we have experienced the double whammy of rising inflation and rising interest rate. Alternative investments such as gold and commodities can hedge the volatility over the short term, and many fund managers have increased their exposure to these in recent times, but if you look over the longer-term, equities have historically outperformed - you just have to have the stomach to stay in the markets.

*https://www.fidelity.com.sg/beginners/what-is-volatility/volatile-times

Market downturns are not a new phenomenon but they are uncomfortable. Volatile markets produce large one day swings and if you try and spot the markets – selling out to buy back in - you will often miss the best “up” days. The best and worst trading days often occur very close together and within the same trading year – to miss out on the best days has a significant impact on the overall performance of your portfolio lowering longer term returns. When the recovery comes you want to be invested.

Fund managers are making daily decisions on their portfolios, positioning them to reduce the investment risk whilst taking advantage of any opportunities that the volatility provides. It is important to remain invested in diversified portfolios and focus on your longer-term objectives.