Pensions Explained: The A to Z of Pensions

The pension industry is surrounded by confusion, from changes to retirement age through to pension allowance date changes. At KDW our pension advisers help their client’s to navigate their way through the complex pension market. We decided to create this guide to help people understand the terminology when they are pension planning...

A

Annual Allowance

This refers to the maximum amount you are able to save tax-free into all of your UK pension schemes. Your own annual allowance will be based on your income; it is currently capped at £40,000. It is important to remember that this allowance applies to all of your pension schemes and not per scheme.

If your contributions surpass the annual allowance then the contributions that are exceeding the allowance will not be subject to tax relief and will receive an annual allowance charge.

Annuity

An insurance contract which will provide, based on how much money you have and an assessment of how long you are likely to live, a guaranteed income for life.

Auto Enrolment

Employers are now required by law to enrol their employees in to a pension scheme which is known as auto-enrolment. There are compulsory contributions rates which the employer must pay; these rates are due to rise over the next few years.

Additional Voluntary Contribution (AVC)

When a person contributes additional amounts to a company pension scheme so as to secure additional benefits, the additional amounts are referred to as additional voluntary contributions.

B

Basic State Pension

This refers to a regular payment which you will receive at state pension age if you are a man born before the 6th April 1951 or a woman born before the 6th April 1953. To be eligible for this you must have either paid or been credited with National Insurance contributions.

If you are a man born on or after the 6th April 1951 or a woman born on or after the 6th April 1953 then you the new state pension rules will apply to you. Please see State Pension in our glossary.

Beneficiary

The person whom you choose to inherit your pension after you pass away. This doesn’t necessarily have to be your spouse or civil partner. Ensure that your pension provider has up to date details of your beneficiary.

BR19

A form which is submitted, up to four months prior to your retirement age, to the Benefits Agency so as to receive an estimate of your state pension entitlement.

C

Carry Forward

If in the previous three tax years you have not used all of your annual allowance you are able to make up those contributions while still receiving tax relief. To use the carry forward rule you will need to have made the maximum contribution in the current tax year, you will then have access to the unmet allowances from the three previous tax years.

Capped Drawdown

This is a type of income drawdown which was available before 6th April 2015. A capped drawdown of your pension pot is invested into funds which should pay you an income. The amount of income you are able to take is capped at 150% of the income a healthy person, of the same age could get from a lifetime annuity.

D

Defined Contribution Pension

This is most common type of pension and refers to a pension pot that is built up using your contributions and if applicable your employer’s contributions. If the pension scheme is with your employer then they will deduct the contributions from your salary pre tax whereas a private pension requires you to arrange the contributions yourself.

Defined Benefit Pension

When you retire a defined benefit pension will pay an amount based on the years you have worked for your employer and the salary which you have earned. If you’ve worked for a large employer or in the public sector then you may have this type of pension scheme.

Death in Service

Some employers offer this as part of their benefit scheme. The scheme may pay out a lump sum, pension or benefits to the deceased spouse or partner if the employee passed away while in service.

Deferred Pension

When an individual has been part of an occupational pension scheme and is no longer active but has not yet retired, that particular pension will be deferred and payable at retirement.

E

Employee Communications

To run a compliant auto enrolment scheme employers are required to send out communications to their employee’s which must provide information regarding the pension scheme, their retirement options, investment choices, contributions, costs and charges.

F

Flexible Drawdown

Similar to the capped drawdown however there is no upper limit on the amount of income that members of the scheme can take.

Final Salary Pension

Otherwise referred to as defined benefit. Please see ‘Defined Benefit Pension’.

Financial Adviser

For pension’s advice it is helpful to speak to an independent financial adviser, like one of our pensions advisers here at KDW, St Albans. We undertake a financial audit as part of our pension procedure, this allows us to guide you through the various different options available to help you plan your retirement. Find out more here: https://www.kdw.co.uk/financial-services/pensions

G

Group Personal Pensions

A type of defined contribution pension which may be offered to employees by their employers. Members of a Group Personal Pension build up a personal pension which they are then able to convert into income once they retire.

H

HM Revenue & Customs

They decide the tax payable on pension contributions.

I

Income Drawdown

Refers to the process of using a pension pot to provide you with a regular retirement income. This is achieved by reinvesting in funds which have been specifically designed for this purpose. The income isn’t guaranteed and will vary depending on the performance of the chosen funds.

J

Junior Pension

While a Junior ISA is the obvious choice for saving for your child, you may also wish to consider a junior pension. Through a Junior Self-Invested Personal Pension (SIPP), open to anyone under the age of 18, you can pay £2,880 per annum which then becomes £3,600 through 20% tax relief. This can be a great way of helping your children in the future and allowing them to use their income for other things such as buying a home.

K

KDW

We are a firm of independent financial planners who have been offering pension advice to clients since 1978. Our pension advisers are based in St Albans, Hertfordshire and offer a whole of market service to our clients. Whether you are just begininning the pension planning process or looking to consolidate your exisiting workplace pensions and personal pensions, KDW pension advisers will work with you to ensure their retirement plans allow them to enjoy a comfortable and happy retirement..

L

Lifetime Allowance

This is the maximum value of benefits that can be taken from a pension scheme, if you exceed this amount you will be subject to the lifetime allowance charge.

Lifetime ISA (LISA)

Scheduled to launch in April 2017, the LISA has been designed to help people save towards either retirement or a deposit for their first property. To open a LISA you will need to between the ages of 18 and 40 and able to save up to £4,000 a year. At the end of each year a 25% bonus will be payable on the amount saved.

M

Money Purchase Annual Allowance

If you have accessed a pension flexibly then you will be subjected to a lower annual allowance of £10,000 rather than the standard £40,000.

N

Normal Pension Age (NPA)

The age at which a member of a pension scheme can receive full pension benefits.

O

Opt-Out

Although it is a legal requirement for an employer to offer a workplace pension as part of auto enrolment, employees are given the chance to opt-out of paying any contributions.

P

Pensions Administration

This refers to the day to day running of a pension scheme. This can be managed internally or contracted out to a third party.

Pension Commencement Lump Sum (PCLS)

When you begin to draw from your pension you normally will have the option to withdraw a tax-free lump sum.

Pension Freedom

In the 2014 budget the government announced that from the 2015/2016 tax year anyone aged 55 and over are able to withdraw their entire pension as a lump sum. The first 25% would be tax free and the remaining 75% would be taxed in the same way as a salary at their income tax.

Q

Qualifying Earnings

With regards to auto enrolment employers are required by law to make a contribution to their employee’s pension based only on their qualifying earnings; which refers to band of earnings. The qualifying earnings will be reviewed by the government each year, for the 2016/17 tax year this is between £5,824 and £43,000 a year.

R

Retirement Age

Pre 2011 there was a compulsory retirement age of 65, however now employers cannot force employees to retire when they reach the age of 65. A private pension can be accessed from the age of 55 and a state pension in your 60’s. There is a timetable in place for when you are eligible to receive your state pension based on your year of birth.

S

Self-Invested Personal Pension (SIPP)

A type of private pension where the individual is responsible for choosing their own investments. If you are interested in this option you should feel confident undertaking your own investment research.

Small Self Administered Scheme (SSAS)

An employer-sponsored defined contribution workplace pension where the employer has additional flexibility with their investments.

State Pension

The new state pension was launched in April 2016 and applies to women born on or after 6th April 1953 and men born on or after 6th April 1951. The amount that you will receive under the new state pension will be based entirely on your National Insurance (NI) record. For the current tax year (2016/2017) the full amount paid is £155.65 and to be eligible for this you will need 35 years NI record.

T

Transfer Value

When you leave a job where you have been paying into a pension scheme you don’t lose the benefits accrued, instead you can transfer them to another pension scheme. The pension administrator will be able to provide you with a calculation of what you are entitled to, the transfer value.

U

Uncrystallised Pension Funds

A pension fund/benefit which has not yet been drawn. When you are ready to access your pension benefits it is recommend that you meet with an independent financial adviser to discuss the available options.

V

Very Confused? – If you find the whole pension process then speak to an independent financial adviser, like KDW who will be able to help you plan your retirement by discussing your options with you in a simple straight forward manner.

W

Winding Up

This refers to the process of closing an occupational pension scheme.

X

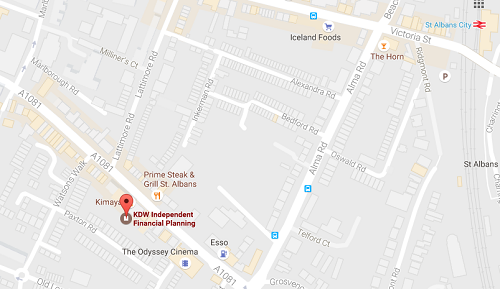

X Marks the Spot

If you would like to discuss your retirement planning with one of our independent financial advisers, then you can find us at Centurion House, 136-142 London Road, St Albans, Hertfordshire, AL1 1PQ.

Y

Yield

This is a measure of the annual income earned on an investment.

Z

Zero Stress

At KDW we understand arranging your pensions can be stressful which is why our advisers work to remove all the stress from the pension process for you by helping you throughout the whole process.

We hope you have found this guide useful, if you have any questions or would like to arrange a meeting with us to discuss your pension planning then please do not hesitate to contact us:

Tel: 01727 85 22 99

Email: mail@kdw.co.uk

2nd Floor Centurion House, 136-142 London Road, St Albans, Hertfordshire, AL1 1PQ.

Past performance is not necessarily a guide to future performance. The value of investments and the income from them can fall as well as well as rise and you may not get back the amount originally invested. Your home may be repossessed if you do not keep up repayments on your mortgage.