Lies, Damn Lies and Reciprocal Tariffs

After all the turmoil of the last 5 years a client asked me in January this year what I was hoping for over the next 12 months. My reply was simple; a quiet, boring year where nothing really happens. Enter Donald Trump, although it might as well have been Donald Duck for all the logic that seems to be applied to diplomacy and economic policy. This article attempts to rationalise the conclusion I come to which is an active decision to do nothing, for now.

So, what can we take from Trump’s first quarter in charge? Trump has a certain modus operandi, which he always employs. Go in with massive disruption and incoherent plans and policies in an attempt to confuse and disorientate. This has been evident in his negotiation on the Ukraine War with Zelensky and his sidling up to Putin. It has of course made Europe sit up and unify, so you could argue that his tactics have worked to some degree as Europe increases spending on defence, a truly Machiavellian outlook where the end justifies the means. The only problem to the negotiations on the war is that it hasn’t ended, and he is as likely to walk away and forget the whole thing – blaming someone else for his lack of a Noble Prize.

Trump is adopting a similar approach to the economy. The US market was going so well before Christmas. After Trump’s inauguration there was huge optimism that the US was going to have a great few years with deregulation, tax cuts, low inflation, removal of the green agenda, just as it had in his first term. He then rediscovered tariffs. He loves them; I’m not convinced he understands them, but as I write, the mood has soured as the merry go around of on/off tariffs has created market uncertainty and a massively volatile stockmarket the US and further afield. Add to this the Elon Musk chainsaw wielding factor and you have a chaotic opening quarter.

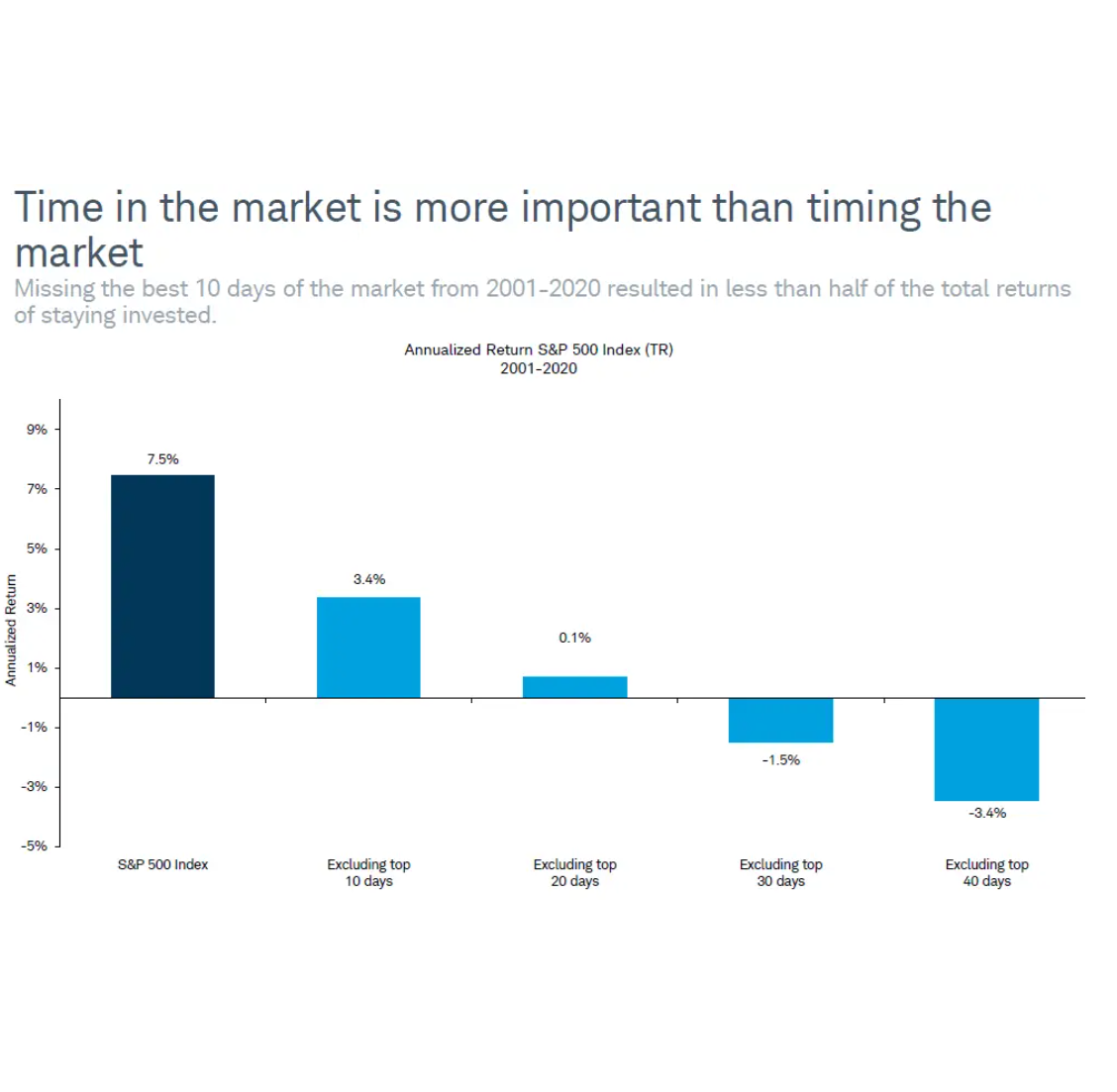

The optimistic gains of the Trump election bounce have all disappeared and markets are down year to date. However, we must keep a sense of perspective. Yes, markets are uncertain, but history has shown us that short-term volatility is the price for longer term capital growth. Undoubtedly if you’d switched into cash on 1st January you’d have weathered the downturn, but the danger of switching and trying to time getting back in to the market is notoriously difficult if nigh on impossible. Market volatility means that they rise and fall by a few percentage points each day. If you switch out and then miss only a few of the positive days, you consolidate the downturn.

Let’s examine the S&P 500 as I write on 3 April at 8pm (S&P 500 is the main US index and contains the so called Magnificent 7 super tech companies). The S&P 500 is down 7.49% year to date (down 4.37% today as a reaction to that bizarre press conference yesterday announcing the tariffs). Over 6 months its down just 4.72%, over 12 months its up 4.23% and over 2 years is up 31.74%.

The chances are if you have a multi asset portfolio within KDW’s investment process, a balanced fund portfolio will have about a 30% exposure to the US market. The fund managers that run the portfolios have been reducing exposure to the US, but of course Trump’s tariff policy also affects other world markets. Most markets have fallen or stagnated since the turn of the year although, ironically, with Europe looking to invest heavily in defence – and spend the money within Europe - could Trump’s MAGA slogan actually be renamed MEGA (Make Europe Great Again). The irony would bring a wry smile to my face. The truthful answer is we don’t know. We are in somewhat uncharted waters but if Trump is true to form there is no reason why he won’t row back on these disruptive policies having used them to negotiate “a deal” and markets will stabilise. The uncertainty is certainly hurting markets and short-term performance. Conventional wisdom tells us to stay invested in a diversified, well managed portfolio for now and remain focused on the longer term. This doesn’t mean to say we are complacent and we at KDW are in daily contact with a variety of the fund management groups to gauge their perspectives and strategy. Nothing lasts forever and in the same way that we have managed investments through the 1987 crash, the Exchange Rate mechanism crisis in 1992, Gulf Wars, the 2008 financial crisis, COVID and the Ukraine War, we will be working hard to come through the latest turmoil.

Obviously not the boring start I’d requested from my client conversation, but one quarter is a very short investment term to analyse. If you need to get in touch with us please do pick up the phone for a reassuring chat.

The sun is out, so I wish everyone a happy weekend.

Marcus Maisey