1 in 5 first-time buyers are choosing a longer mortgage term to balance costs

Struggling first-time buyers are opting for longer mortgage terms to get on the property ladder. Yet, it could mean they pay far more in interest overall. If you’re weighing up the pros and cons of taking out a mortgage over 35 years or more, read on.

It’s easy to see why more first-time buyers are choosing “marathon mortgages”. House prices have steadily increased over the last few decades but average wages haven’t kept pace. So, first-time buyers have long faced challenges in saving a deposit and accessing the mortgage they need to buy a home. On top of this, interest rates started to rise at the end of 2021.

In a bid to manage their budget, many first-time buyers are choosing to repay a mortgage over a longer period, as repayments will typically be lower compared to mortgages with shorter terms.

In fact, according to figures from UK Finance, 1 in 5 first-time buyers applying for a mortgage in the first three months of 2023 chose a mortgage term of 35 years or more.

A longer mortgage term could mean you pay thousands of pounds more overall

One of the main reasons first-time buyers are choosing longer mortgages, is it could reduce their monthly repayments.

Let’s say you use a repayment mortgage to borrow £250,000 at an interest rate of 5.5%. With a 25-year mortgage term, your repayments would be £1,535. However, extend the mortgage term to 35 years, and the repayments fall to £1,342.

While a longer mortgage means your repayments will be lower, over the full term, you could pay much more in total.

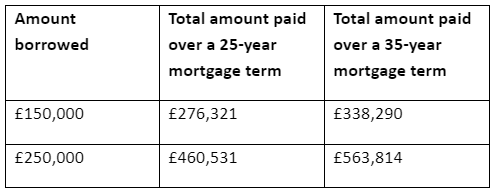

The table below shows how the total cost of borrowing changes depending on whether you’re repaying the money over 25 or 35 years on a repayment mortgage with a fixed interest rate of 5.5% throughout the term.

Source: MoneySavingExpert

So, while a longer mortgage term could make sense for your short-term finances, it may not be as beneficial overall when you look at the bigger picture.

One important factor to note is that it’s unlikely you’ll pay the same interest rate throughout the entire mortgage.

As you make repayments or the value of your home increases, the amount of equity you hold usually rises. Often, the more equity you have in your home, the more favourable the interest rate you can access.

Other factors, such as the Bank of England changing its base rate, may also affect the interest rate you’re offered.

So, while reviewing the total cost of borrowing based on your initial interest rate is useful, keep in mind it could change.

2 useful ways to reduce the cost of borrowing

While the figures show the long-term financial benefit of choosing a shorter mortgage term, many first-time buyers are opting for a marathon mortgage out of necessity.

If a longer mortgage term provides a way to get on the property ladder, there are also things you could do to reduce the total amount of interest you pay. Here are two possible options:

1. Make overpayments

When you make overpayments on your mortgage, this goes directly towards reducing the amount you owe. As a result, you reduce the debt and the interest that is added. So, it could be a way to reduce the overall cost of borrowing.

You could choose to make a one-off lump sum overpayment or increase your regular repayments.

Many mortgage deals will allow you to overpay by up to 10% of the outstanding debt each year before you pay a fee. However, this isn’t always the case, so make sure you read your paperwork first to avoid unexpected costs.

2. Shorten your mortgage term in the future

If you choose a 35-year mortgage when you first buy a home, you don’t have to stick to this timeline.

As your financial circumstances change, you may shorten the mortgage term in the future. It’s often a good idea to review your mortgage term when your existing deal ends.

Changing the mortgage term in the future could allow you to get on the property ladder now and reduce how much interest you pay over the long term.

Contact us to talk about your mortgage options

As a first-time buyer, navigating the mortgage market can be confusing. We’re here to answer questions you have, from which lender may be right for you to how the interest rate will affect your outgoings. Please contact us to speak to one of our team.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.